by Mark Dice

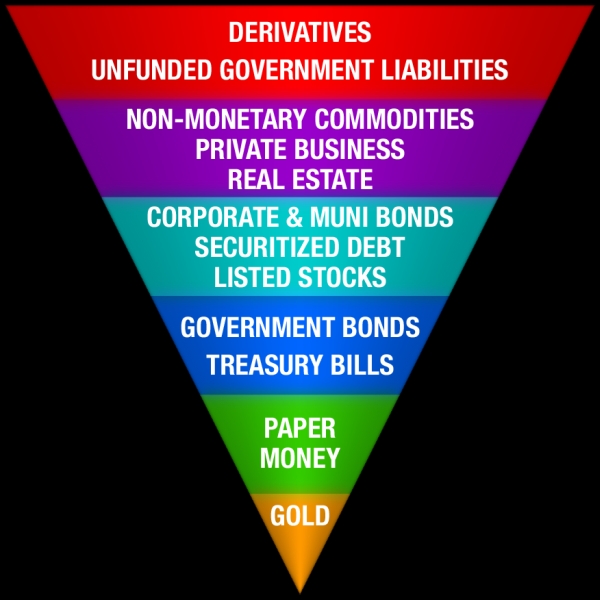

People against the New World Order will often be interested in investing in gold and silver—particularly physical gold and silver—meaning they purchase coins or bars that they themselves take physical possession of, rather than just buying gold or silver stocks or certificates. The reason for this is because gold and silver are seen as real money, as opposed to a fiat currency like the US dollar. A fiat currency is a currency that isn’t backed by gold or silver. Before 1971 the US dollar was backed by gold which meant that for every dollar in circulation, there was one dollar worth of gold in possession by the federal government or the Federal Reserve Bank. This was a way to keep inflation low since the gold supply only slowly increased, so then would inflation.

But in 1971 President Nixon took the US dollar off the gold standard, meaning the Federal Reserve could print money and put it in circulation that was not backed by gold, so the rate of inflation was no longer connected to the amount of gold in existence, but rather to the number of dollars the Federal Reserve wanted to print.

For decades, patriots and those in The Resistance had worried that the Federal Reserve Banking System, which is controlled by a group of private banks operating as if they were a government entity, would one day make the US dollar practically worthless because it would print so many of them it would create what is called hyper-inflation, thus destroying the value of the currency as was seen in the Weimar Republic in Germany in the 1930s, and recently in Zimbabwe, Africa where the inflation rate was so high that a bunch of bananas cost literally billions of Zimbabwe dollars.

Since the year 2000 gold has went from $300 an ounce to over $1100 an ounce in the beginning of 2010. Silver has went from $5.25 an ounce to $18 an ounce in the same timeframe. Some market analysts predict that gold will hit $2000 an ounce sometime into the 2010 decade, and others are even predicting $5000 an ounce. Much of the increase in the price of gold and silver isn’t because the metals are getting more rare, but rather the price is a reflection of the weakening US dollar. Gold and silver have been seen as a hedge against inflation for decades and most financial advisers recommend that 10% of a person’s investments should be held in gold.

In a video that got several hundred thousand views on YouTube, this author offered to sell random strangers walking along a boardwalk on a beach a one ounce gold coin for $50, and in some cases, $20, and once tried to trade it for a cup of coffee, but nobody expressed any interest. Some didn’t want the coin because it was Canadian and didn’t think it had much value in America, not realizing that a one ounce gold coin stamped with a picture of Mickey Mouse is still an ounce of gold and can be sold at any coin shop for whatever the spot price of gold is going for that day.

(Excerpt from The New World Order: Facts & Fiction by Mark Dice – Available on Amazon.com, Kindle and Nook.)

Some of the comments on the video by the viewers said they thought the people I approached thought it was a fake coin and that was why they didn’t want to buy it for fifty bucks. These people missed the point of the video which was to show that very few people have any clue whatsoever about what the value of gold is, so I shot another video to clearly illustrate this.

In the follow up video I offered random passer-bys the coin for free if they knew or could guess how much gold was trading for that day within 25%. You have to see the video to really grasp the impact of it, and if you watch it you will see that adults over the age of 30 guessed as low as thirty-eight cents and as high as $245. At the time the video was shot, gold was trading for $1150 per ounce. After the “contestants,” as I called them, gave me their answer, I told them how much the coin was actually worth and captured their reactions on the video.

People concerned with the New World Order are especially interested in owning physical gold and silver because they are aware of the elite’s ultimate goal of establishing one currency for the whole world, and in order to accomplish this it is likely that the United States dollar will have to be made practically worthless through hyper-inflation at which point the solution for this currency crisis will be the introduction of a new regional currency or an adoption of a global currency.

Another reason for physically holding a collection of silver coins (usually one ounce coins which is the standard weight) is the possibility that a community barter system or an underground economy may have to be used for a period of time during a hyper-inflation scenario. In the event of a hyper-inflationary depression and the US dollar becomes practically worthless, or loses 90% of its value in a short time frame, small mom and pop stores, as well as neighborhoods and perhaps entire communities may start using one ounce silver coins as money to exchange goods and services. A small local bakery may only sell loaves of bread for a one ounce silver coin, or someone with a large farm or garden may sell their produce to others in their community, but only for silver. If this sounds far-fetched you should be aware that during the hyper-inflation in Zimbabwe, street vendors stopped taking the country’s currency because of the massive daily inflation, and would only accept grams of gold for payment.#

Since a one ounce gold coin has a fairly high value, it is advised that you purchase and hold onto at least a small amount of one ounce silver coins because their value can be matched with various products or services. In the event of this kind of a black market economy arising, very few transactions would need to be made in gold because one ounce of gold is worth approximately 50 times what an ounce of silver is worth. If a loaf of bread is selling for one ounce of silver, and all you have is one ounce gold coins (or even half ounce or quarter ounces) then you’re going to have to buy way more bread than you could possibly need at the moment. This would be like shopping at a Dollar Store with only $100 dollar bills and the store wouldn’t be able to give you any change.

(Excerpt from The New World Order: Facts & Fiction by Mark Dice – Available on Amazon.com, Kindle and Nook.)